Content

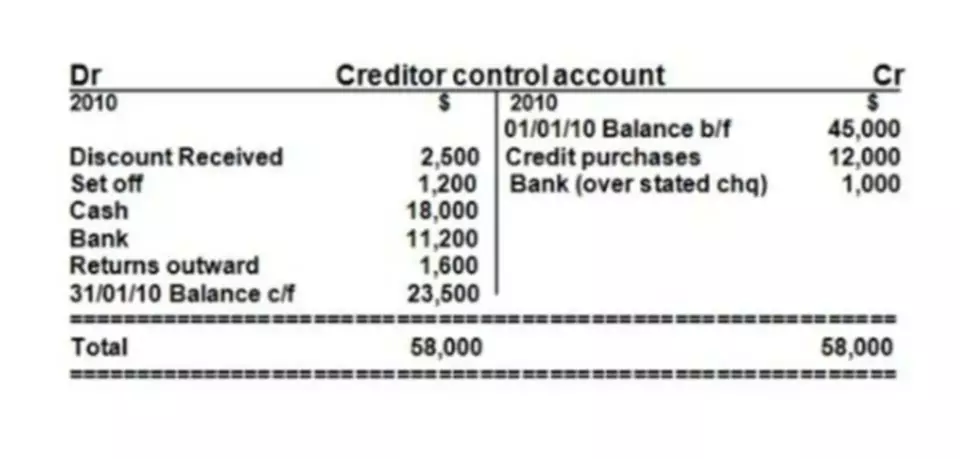

Have startup bookkeeping and bookkeeping practices that are followed weekly and monthly to set your startup up for success. Enter in all data of transactions, reconcile your accounts, and keeping up on accounts receivable are all ways your business will keep up with accuracy and keep cash in the bank. Financial statements will be the best friend to the business. Having a good CFO, accountant and bookkeeper will aid in tracking and utilizing financial statements. Accurate books will help you see that you have enough money coming in and out of business. It will also help you save time and make critical business decisions.

Entity types and accounting methods can get pretty complex. We recommend chatting with a CPA before you make any firm decisions.

One of the important tasks of a https://www.bookstime.com/ is reconciling the statements periodically (e.g., weekly, monthly, or sometimes quarterly) to ensure your financial statements are accurate. The success of your startup is based on efficient budget management, balancing the books, and modifying financial strategies when needed. Effective accounting practices and sound financial management results in returns for the stakeholders and business owners. Talk to an accounting firm that provides bookkeeping and other services to startups. They can help you determine which services are right for you and how you can take advantage of experienced accounting talent without busting your budget. We do more than just the day-to-day bookkeeping and bookkeeping services that allow you to focus on running your business. An experienced accountant can help you review your records and use their knowledge to identify every potential tax deduction or tax credit for your business.

Of course, the product has the usual bookkeeping tools. These include a general ledger, financial reconciliation, cost of goods functionality, and inventory accounting. A2X also supports multiple currencies and multiple seller accounts.

Find out what makes them tick so you can retain them longer and find more just like them. We recommend filing your receipts and old invoices weekly. Otherwise, you’ll lose them and might not be able to prove certain expense deductions if you get audited. In fact, this card is so good that our experts even use it personally.

In this way, you won’t have to manually encode data for your bookkeeping records. Also, if you are a startup business owner who is not familiar with the proper ways of bookkeeping, QuickBooks Online offers the service of certified bookkeepers. We recommendQuickBooks Online(“QBO”) as the right bookkeeping software for startups and high-growth small businesses. It’s the leading small business accounting software in the US for small businesses, and interfaces nicely with other automated systems like payroll. Is helping small businesses to better manage their supplier payments, minimizing time and cost while maximizing cash flow.

Nvesting in the right software and tools early on can be a game-changer for startups. Like other top applications, Xero works well with other third-party solutions. These include Square, Vend, Expensify, Mogul, and Zenpayroll. Lastly, it also has mobile apps for both iOS and Android devices. Furthermore, FreshBooks has a mobile application for iOS and Android devices. This app allows you to generate invoices for your clients no matter where you are. Many small business owners find they need some funding to get…

Growing – Includes all from the Early plan, plus customers can send unlimited invoices and quotes, enter bills, and bulk reconcile transactions. Early – Customers can send quotes and 20 invoices, enter 5 bills, reconcile bank transactions, capture bills and receipts with Hubdoc. Solution – Includes everything in the Starter plan plus 200 automatic readings per month, synchronization and bank reconciliation, complete business documents. Quipu offers solutions such as billing, tax, document management, treasury management, invoice digitization, banking, and reconciliation programs. Large – Plus unlimited historical data import, extended inventory tracking, product mapping, bundles and assemblies syncs, white-glove onboarding, and unlimited users. Also, the software provider offers self-service learning tools. And, it has a large active community of users that help each other optimize their software use.

They can also help you identify areas where you’re overspending and provide guidance to help you reduce your burn rate. Is accounting software that facilitates proposals, payments, insights, scope management, and integrations. With Practice Ignition businesses can remove the friction by sending their clients a single smart proposal they can read, sign and make a payment on in one sitting. Other key features include PO generation, flexible forms, and duplicate requests. Moreover, Tipalti Approve provides team management tools.

Why bookkeeping is important for Startups Startup Launcher EP 06.

Posted: Mon, 06 Feb 2023 07:29:03 GMT [source]